Technology

The Companies that Defined 2021

The Companies that Defined 2021

Attention is an increasingly valuable form of currency in the Information Age.

In 2021, a handful of companies stood out from the pack, dominating the conversation and influencing society in both positive and negative ways. After vigorous internal debate, here is Visual Capitalist’s list of companies that defined 2021:

- Robinhood

- Pfizer

- Coinbase

- Tesla

- TikTok

- Facebook/Meta

We looked at a number of metrics to select these companies, including Google search and news volume, performance relative to competitors, industry-specific indicators, and more.

Many of these are digital companies, and all have massive reach, scale, and influence. Interestingly, many of these companies also faced controversies along with their success, and were caught up in movements that were bigger than themselves.

With this context in mind, let’s dive in.

Robinhood

Robinhood’s eventful year reached its peak when the stock trading app was caught in a frenzy involving retail traders, short sellers, and “meme stonks”. It did not take long for Robinhood to go from hero to villain in this story. As the Gamestop stock shot up past $400, trading was halted and position limits were initiated on the app.

As well, Robinhood’s stated goal of democratizing finance came under scrutiny due to their pay-for-order-flow business model, where sensitive user trade activity data is sold to the highest bidder who then gets ahead of the trade, otherwise known as “front-running”.

Despite the controversy, Robinhood’s platform now has over 22 million users, many of whom are younger, first-time investors. While they have key attractions like zero commission trades, they were also accused of gamifying investing with features like confetti shooting across the screen after a trade is made (a feature that was removed after media criticism).

The company frequently made front page financial news in early 2021, and while the often negative press didn’t get in the way of their IPO—which commenced in late July—it has affected investor sentiment. Since their 52-week high of $70 per share in August, the stock has fallen some 70% towards the $18 range.

Furthermore, the SEC is rumored to be launching an investigation into them. With these headwinds, investing on Robinhood has probably fared better so far than investing in Robinhood.

Pfizer

Perhaps there was no bigger story in 2021 than COVID-19 vaccines.

Early in the year, the race to secure vaccines was on. Wealthy countries scrambled to buy stock and roll out widespread vaccination programs ahead of spring.

And the companies that managed to produce efficient vaccines saw the biggest benefits, like pharmaceutical giant Pfizer. The company’s COVID-19 vaccine, made in partnership with German firm BioNTech, ended up becoming the world’s most-preferred vaccine to fight the pandemic.

The company is forecasting revenue of $36 billion from its vaccine this year.

Competing vaccines from Moderna and AstraZeneca also saw their parent companies rise in both market cap and newsworthiness. All of the involved pharma companies have also faced constant scrutiny, with many countries in the world struggling to secure COVID-19 vaccines, and others dealing with vaccine hesitancy.

As the pandemic continues with the Omicron variant quickly spreading around the globe, Pfizer and its competitors will continue to be impactful into the new year. The company announced a COVID-19 antiviral pill that is planned to be released in the near future, and more effective vaccines and boosters against other variants are still a hot commodity.

Coinbase

2021 was a pivotal year for cryptocurrency. Prices reached new highs, and institutions and retail investors alike poured into the market.

With its user-friendly app and focus on security, Coinbase was well positioned to benefit from this surge in interest. The exchange started off the year by more than doubling its transacting user base as Bitcoin prices shot to new heights.

It’s easy to underestimate the influence of the company’s IPO—especially as its share price slid as the crypto market cooled off—but the exchange’s very entry into the public markets was a huge boost in legitimacy for crypto, paving the way for similar companies to IPO in the future.

Tesla

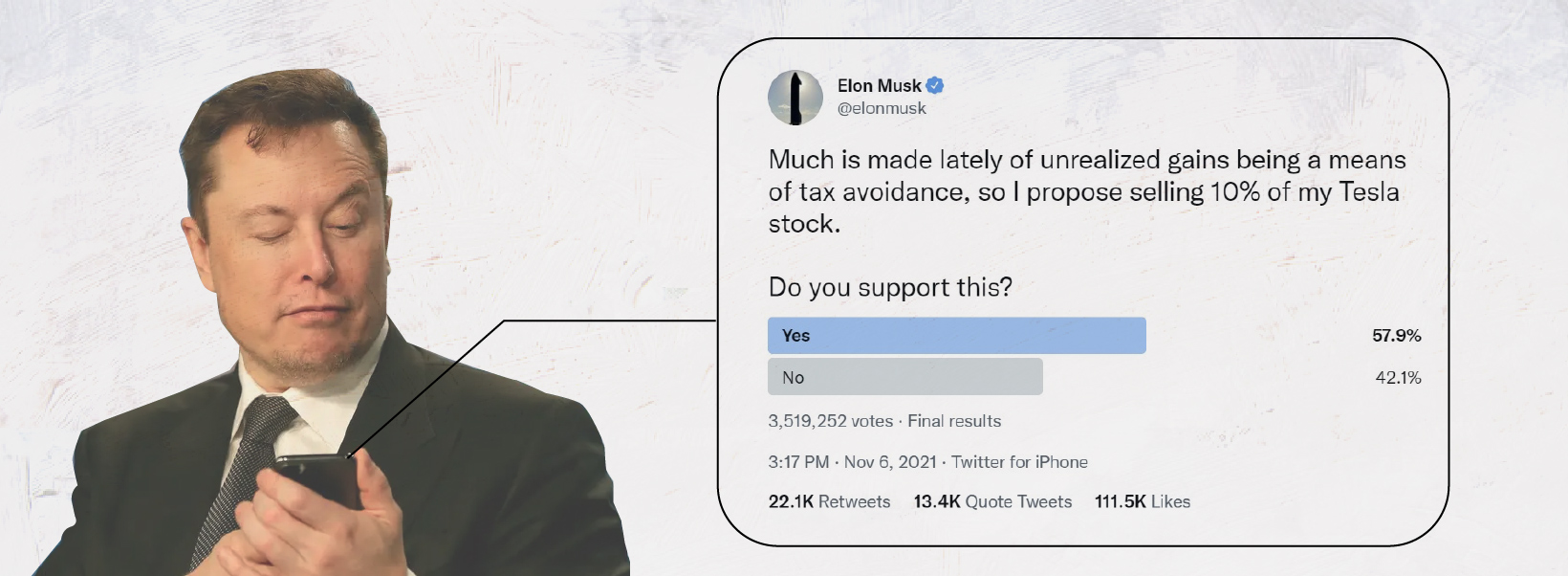

Nobody captures attention and creates controversy quite like Tesla’s CEO, Elon Musk.

Most of Tesla’s actions are tied closely to the famous entrepreneur, who’s known for his brazen online presence. Musk’s social media persona is so strong, one tweet can send Tesla’s stock plummeting, like it did last year after Musk told Twitter that “Tesla’s stock is too high imo.”

While naysayers are quick to criticize Tesla and Musk, the company has some impressive numbers to back up its hype. 2020 was already a ridiculous year for Tesla—its stock surged by nearly 700%, and with a valuation of $630 billion, it became one of the most valuable companies in the world.

This momentum carried over into 2021. This year, revenue rose each quarter, and in October, the company’s market value surpassed $1 trillion.

Tesla was also intertwined within other societal narratives over the course of the year. The automaker’s move from California to Texas was part of a larger conversation about the “Bay Area exodus”, as jurisdictions in Texas and Florida looked to steal Silicon Valley’s thunder.

Musk’s Tesla stock sales generated a lot of buzz in Q4 as well.

Seemingly in response to criticism over inequality and tax avoidance, Musk ran a Twitter poll to decide whether or not to sell a significant portion of his Tesla holdings. After a majority “yes” vote, the Tesla CEO now appears to have sold off enough stock to hold up his end of the bargain.

TikTok

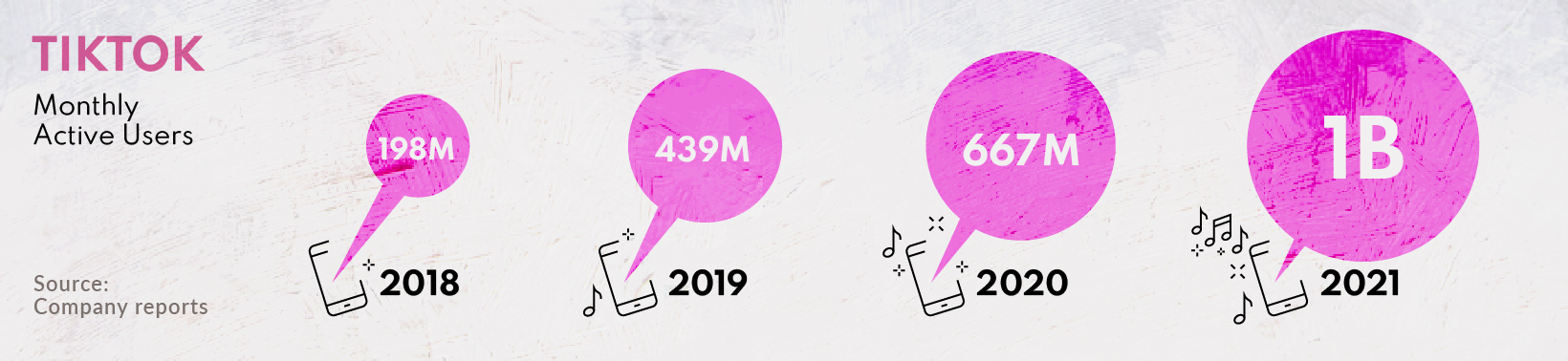

TikTok was already popular in 2020, but this year truly solidified its status as a cultural phenomenon.

The app topped a billion users in 2021, just five years after its launch in 2016. For context, it took Facebook and Instagram nearly eight years to hit that same milestone.

What’s so appealing about TikTok? Experts have many theories, but in an interview with Forbes, John Holdridge, GM of Fullscreen, puts its simply: “TikTok’s success can be attributed to how it flips what we think of as social media on its head, while at the same time returning us all to roots of the original appeal–the ability to go viral.”

TikTok’s short-style video format has become so popular that it’s inspired a slew of copycat apps, especially in regions like India where TikTok is banned.

Even established companies like Meta have tried to mimic TikTok’s success. In 2020, Instagram launched “reels,” its own short-form video feature where users can create and share 30 second videos. But Instagram reels failed to overtake TikTok’s growth—instead, reels has become a place for users to share and promote their TikTok videos.

Facebook/Meta

Facebook frequently finds itself in the news, given its status as the world’s largest social network. In 2021, however, it was for two different reasons.

The first was the U.S. Capitol Riot on January 6, 2021. In the aftermath of this event, many blamed Facebook for not doing enough to mitigate the negative effects of its platform—mainly polarization, conspiracy theories, and hate speech.

The controversy reached its peak in September 2021, when internal files leaked by whistleblower Frances Haugen were published. These documents exposed Facebook’s internal struggles with combating misinformation, as well as employee dissent.

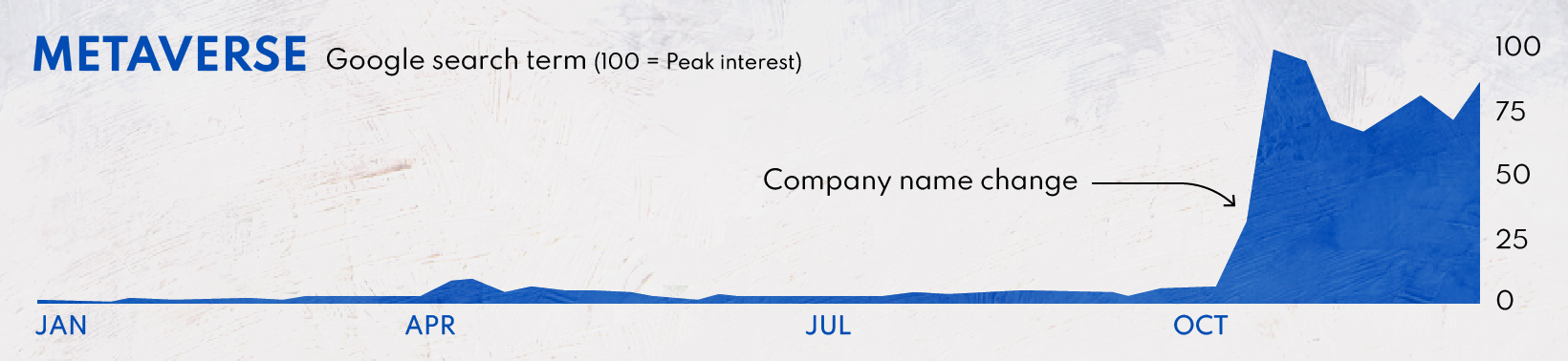

Ultimately, Facebook weathered the storm and opted to shed its baggage with a new name. Not only does this help the company disassociate from its previous scandals, it also lines up with Mark Zuckerberg’s ambitions of pioneering the metaverse.

Following the announcement, “metaverse” exploded overnight and became one of the hottest topics of 2021. The word “Meta” has also become incredibly valuable—Meta (the company) recently completed a $60 million deal to acquire the trademark assets of Meta Financial Group, a regional U.S. bank.

Honorable Mentions

While the companies highlighted above were undeniably influential in 2021, any list like this is bound to be subjective and open to debate. Here is a shortlist of other companies that we considered for the Companies that Defined 2021 list:

The surge in investment that propelled Robinhood and Coinbase to new heights was partially fueled by communities on Reddit. One of the most fascinating moments of the year came when Reddit user u/deepfuckingvalue appeared before the House Committee on Financial Services proclaiming, “I am not a cat” and “I like the stock”.

On the business front, the “Front Page of the Internet” saw double-digit user growth during the pandemic, and now has a valuation of $10 billion after a hefty round of funding.

OpenSea

NFTs had a Cambrian explosion alongside the crypto bull run, with OpenSea emerging as the dominant marketplace this past year. In the second half of 2021, OpenSea made up 95% of NFT trading volume on major marketplaces, and has transacted $1.42B in volume in December so far.

While it seemed OpenSea was planning an IPO after their CFO Brian Roberts commented how “you’d be foolish not to think about it [OpenSea] going public,” user backlash resulted in Roberts later tweeting that the company is not actively planning an IPO. Whether or not OpenSea does set sail onto the public markets, they’ll soon have some serious competition from Coinbase’s own NFT marketplace currently in the works.

Netflix

Despite intense competition from rival streaming platforms, Netflix will finish the year on top once again. The company has a number of impressive tallies in the win column this year.

First, Squid Game was a cultural phenomenon, quickly becoming the streaming service’s number one show, and also the world’s most Googled TV show of 2021.

Next, Netflix’s Red Notice is likely the most watched new movie of 2021, logging well over 300 million hours of viewing time. Not bad, considering its tepid score of 36% on Rotten Tomatoes. It remains to be seen whether deep-pocketed competitors like Disney+ are able to dethrone Netflix, but for now, the company is as culturally relevant as ever.

SpaceX

The fact that Elon Musk has two companies in this conversation points to why he was named Time’s Most Influential Person for 2021.

SpaceX has made launching rockets drastically cheaper in recent years, which helps explain its massive reported valuation of $200 billion. The company, which is the top commercial launch provider in the U.S., will round out the year with 31 launches.

Which companies would you add to this list?

Technology

Charting the Next Generation of Internet

In this graphic, Visual Capitalist has partnered with MSCI to explore the potential of satellite internet as the next generation of internet innovation.

Could Tomorrow’s Internet be Streamed from Space?

In 2023, 2.6 billion people could not access the internet. Today, companies worldwide are looking to innovative technology to ensure more people are online at the speed of today’s technology.

Could satellite internet provide the solution?

In collaboration with MSCI, we embarked on a journey to explore whether tomorrow’s internet could be streamed from space.

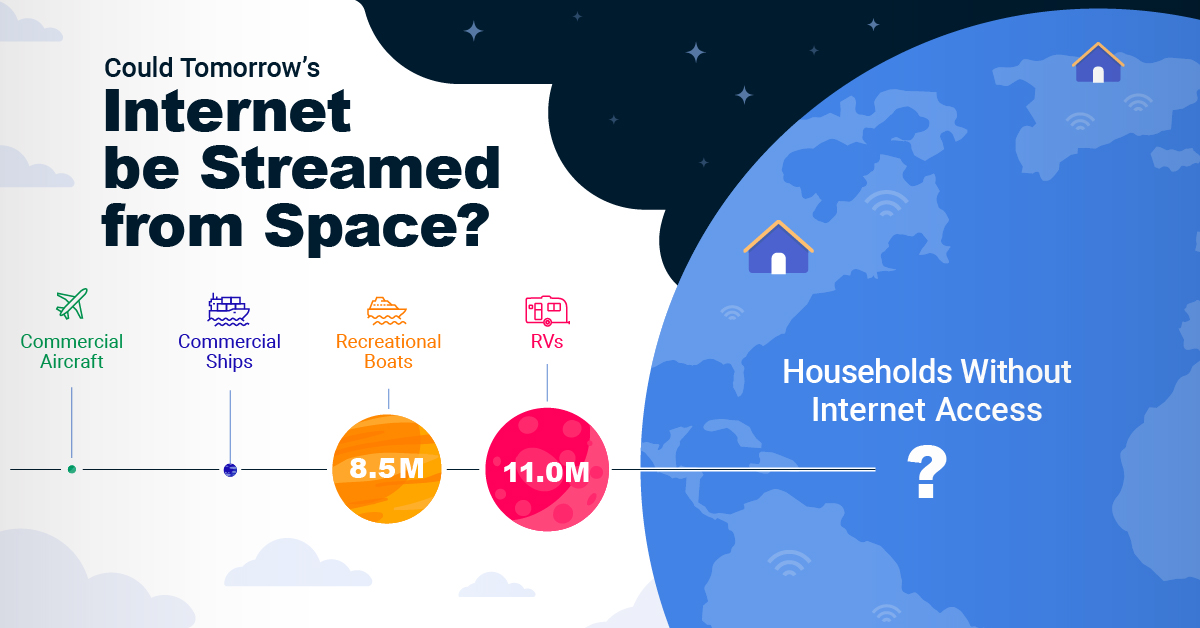

Satellite Internet’s Potential Customer Base

Millions of people live in rural communities or mobile homes, and many spend much of their lives at sea or have no fixed abode. So, they cannot access the internet simply because the technology is unavailable.

Satellite internet gives these communities access to the internet without requiring a fixed location. Consequently, the volume of people who could get online using satellite internet is significant:

| Area | Potential Subscribers |

|---|---|

| Households Without Internet Access | 600,000,000 |

| RVs | 11,000,000 |

| Recreational Boats | 8,500,000 |

| Ships | 100,000 |

| Commercial Aircraft | 25,000 |

Advances in Satellite Technology

Satellite internet is not a new concept. However, it has only recently been that roadblocks around cost and long turnaround times have been overcome.

NASA’s space shuttle, until it was retired in 2011, was the only reusable means of transporting crew and cargo into orbit. It cost over $1.5 billion and took an average of 252 days to launch and refurbish.

In stark contrast, SpaceX’s Falcon 9 can now launch objects into orbit and maintain them at a fraction of the time and cost, less than 1% of the space shuttle’s cost.

| Average Rocket Turnaround Time | Average Launch/Refurbishment Cost | |

|---|---|---|

| Falcon 9* | 21 days | < $1,000,000 |

| Space Shuttle | 252 days | $1,500,000,000 (approximately) |

Satellites are now deployed 300 miles in low Earth orbit (LEO) rather than 22,000 miles above Earth in Geostationary Orbit (GEO), previously the typical satellite deployment altitude.

What this means for the consumer is that satellite internet streamed from LEO has a latency of 40 ms, which is an optimal internet connection. Especially when compared to the 700 ms stream latency experienced with satellite internet streamed from GEO.

What Would it Take to Build a Satellite Internet?

SpaceX, the private company that operates Starlink, currently has 4,500 satellites. However, the company believes it will require 10 times this number to provide comprehensive satellite internet coverage.

Charting the number of active satellites reveals that, despite the increasing number of active satellites, many more must be launched to create a comprehensive satellite internet.

| Year | Number of Active Satellites |

|---|---|

| 2022 | 6,905 |

| 2021 | 4,800 |

| 2020 | 3,256 |

| 2019 | 2,272 |

| 2018 | 2,027 |

| 2017 | 1,778 |

| 2016 | 1,462 |

| 2015 | 1,364 |

| 2014 | 1,262 |

| 2013 | 1,187 |

Next-Generation Internet Innovation

Innovation is at the heart of the internet’s next generation, and the MSCI Next Generation Innovation Index exposes investors to companies that can take advantage of potentially disruptive technologies like satellite internet.

You can gain exposure to companies advancing access to the internet with four indexes:

- MSCI ACWI IMI Next Generation Internet Innovation Index

- MSCI World IMI Next Generation Internet Innovation 30 Index

- MSCI China All Shares IMI Next Generation Internet Innovation Index

- MSCI China A Onshore IMI Next Generation Internet Innovation Index

MSCI thematic indexes are objective, rules-based, and regularly updated to focus on specific emerging trends that could evolve.

Click here to explore the MSCI thematic indexes

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

While the U.S. is a major market for cryptocurrencies, two countries surpass it in terms of their rates of crypto ownership.

-

Technology1 week ago

Technology1 week agoMapped: The Number of AI Startups By Country

Over the past decade, thousands of AI startups have been funded worldwide. See which countries are leading the charge in this map graphic.

-

Technology3 weeks ago

Technology3 weeks agoAll of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

-

Technology3 weeks ago

Technology3 weeks agoVisualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

-

Technology3 weeks ago

Technology3 weeks agoHow Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

-

AI1 month ago

AI1 month agoRanked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

-

Markets1 week ago

Markets1 week agoMapped: The Most Valuable Company in Each Southeast Asian Country

-

Personal Finance7 days ago

Personal Finance7 days agoVisualizing the Tax Burden of Every U.S. State

-

Mining1 week ago

Mining1 week agoWhere the World’s Aluminum is Smelted, by Country

-

Technology1 week ago

Technology1 week agoCountries With the Highest Rates of Crypto Ownership

-

Money1 week ago

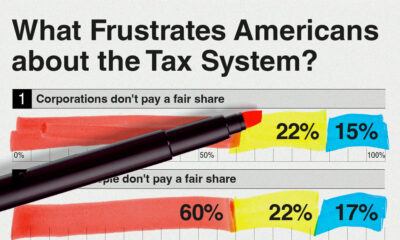

Money1 week agoCharted: What Frustrates Americans About the Tax System

-

Economy1 week ago

Economy1 week agoMapped: Europe’s GDP Per Capita, by Country

-

Stocks1 week ago

Stocks1 week agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Healthcare1 week ago

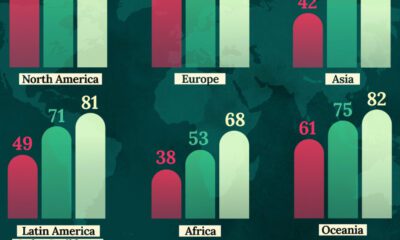

Healthcare1 week agoLife Expectancy by Region (1950-2050F)